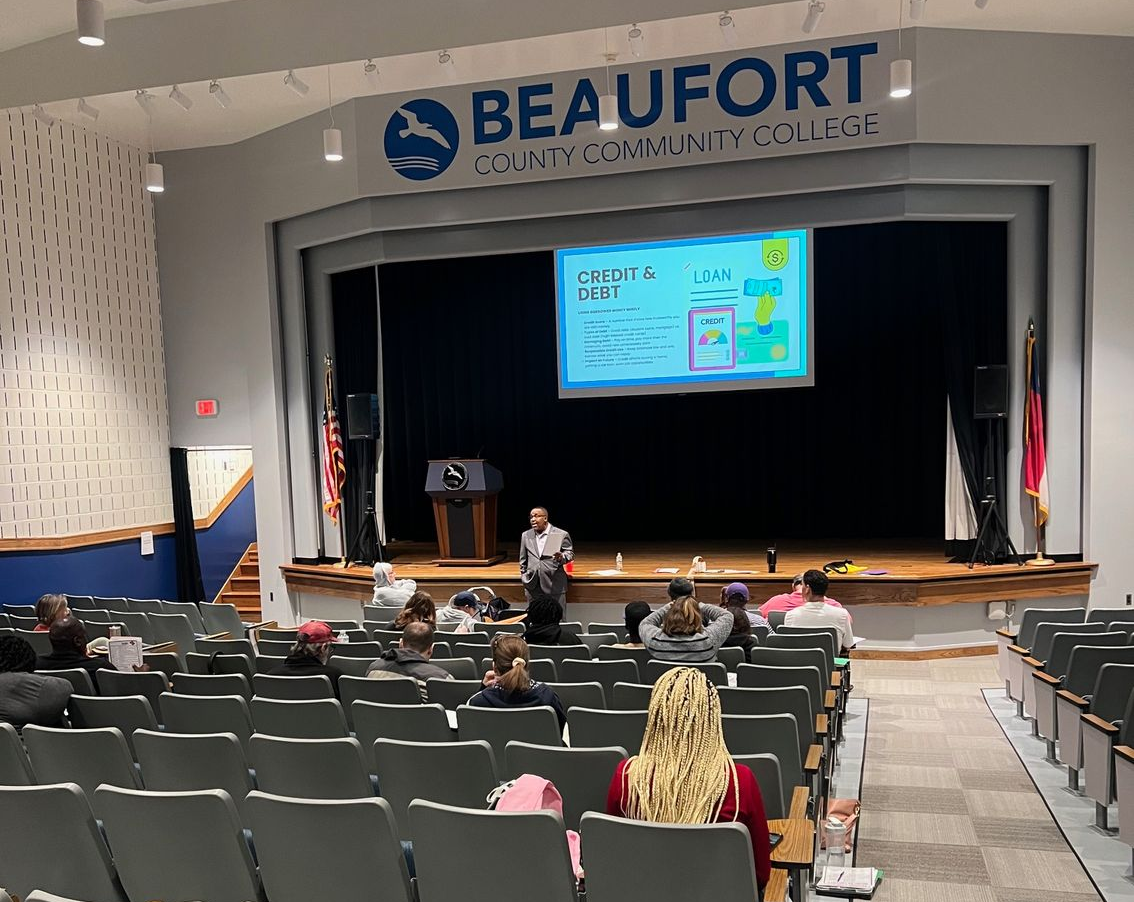

Building Foundations: Financial Literacy & Wellness at Beaufort County Community College

Equipping students with the tools to build stability, confidence, and brighter futures.

The course focused on the essentials of financial literacy—budgeting, credit, savings, and responsible spending—while also connecting those lessons to overall wellness. Students were encouraged to see financial health as an important part of their overall quality of life. Managing money effectively reduces stress, builds confidence, and creates opportunities for independence, whether that means renting a first apartment, saving for a major purchase, or setting long-term goals like homeownership.

What made this opportunity truly impactful was the level of engagement from the GED students themselves. They asked thoughtful questions, shared personal experiences, and connected classroom lessons to real-life situations. Their energy and openness reminded us that financial literacy is not just about numbers—it’s about people, their stories, and their goals for the future.

We are especially grateful to Beaufort County Community College for opening the door to this partnership and recognizing the importance of financial education as part of student development. By including Financial Literacy and Wellness as part of the GED program, BCCC is giving students tools they can carry with them far beyond the classroom.

As a HUD-approved housing counseling agency, Metropolitan Housing & Community Development Corporation is committed to empowering individuals with knowledge that leads to stability and success. Opportunities like this class reflect our mission: to provide resources that strengthen families and communities, while encouraging individuals to take control of their financial future.

To the GED students of BCCC—thank you for your enthusiasm, curiosity, and participation. It was a privilege to share this important journey with you, and we look forward to continuing to expand financial literacy and wellness opportunities in our community.

Authored By:

Karrissa Sutton

Housing Counseling Program Manager

Share On: